Winning! The annual NYC Department of Finance Tax Lien Sale, policy since 1996, puts our neighborhoods at risk in several ways. Here’s what our collective advocacy to protect them has seen so far:

-

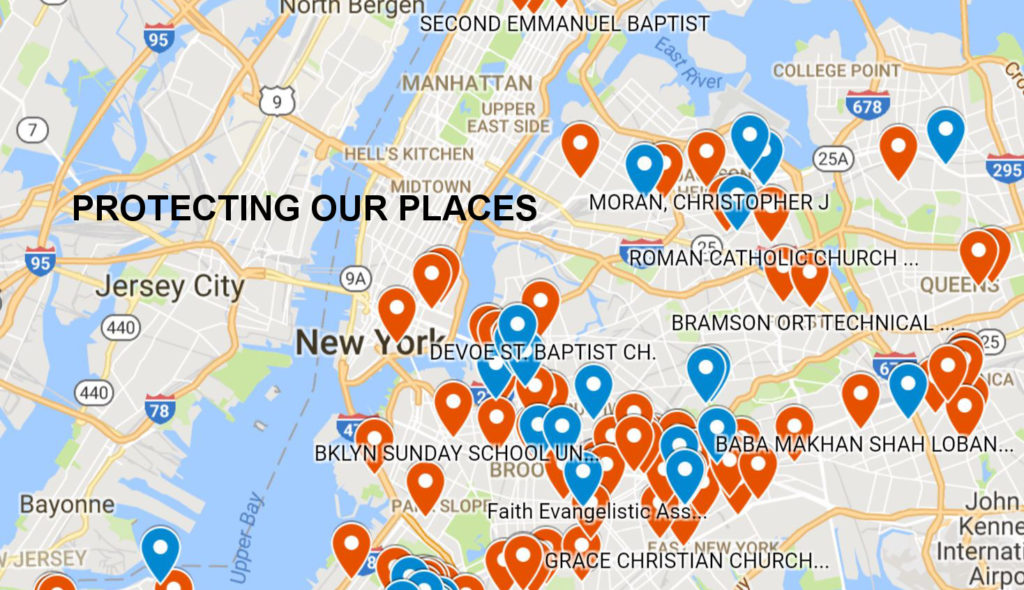

360 active community properties are not in jeopardy

In February, the NYC Department of Finance published a list in response to our advocacy of charity properties with recent tax-exemptions with tax, sewer and water debt heading to the 2017 Tax Lien Sale. There were 536 nonprofit-owned places on that list. We are down to 176.

Nearly 70% of the nonprofit properties on the original list were active. Administrators might not have know that the exemptions they are entitled to by NYS law have to be renewed with NYC annually (this is a relatively new law). Grassroots and elected advocates made phone calls, wrote emails, and visited places, letting people know their places were at risk and helping them get off the list.

176 nonprofit-owned places are still poised to have their illegally-accrued debt sold to a private investment trust this August. The trust can charge 18% interest, compounded daily, pursue collection, and initiate foreclosure leading to sale at auction to the highest bidder. Buyers can do as they please to the structures, including demolish old churches, mosques, synagogues and community centers. See below for how you can help protect the 176 community properties still at risk.

-

The Department of Finance extended the deadline for nonprofits to get off the list to Friday, June 23

This was because we spoke out in unity before the previous May 12 deadline:

- Brooklyn Borough President Eric Adams: “Simply put, houses of worship and non-profits should not be caught in the same tax lien sale net as other properties. At a time when underserved communities find themselves relying on charitable organizations more and more, with those organizations stretched thinner and thinner, we should making a greater effort to help the helpers.”

- Public Advocate Letitia James: “Our charitable institutions and houses of worship are exempt from property taxes and should not be put at risk of foreclosure at the hands of a private bank because of paperwork errors and administrative inefficiencies…”

- Seventeen NYC Council Members: “By selling the right to collect unpaid taxes on community gardens, churches, day care centers, and locations owned by community-based charity organizations, the City is putting these hundreds of key community places at risk of foreclosure by private debt collectors and risking their transformation into private, for-profit development sites.” Signers were Ben Kallos (3rd District), Antonio Reynoso (34th District), Stephen Levin (33rd District), Deborah Rose (49th District), Corey Johnson (3rd District), Rafael Espinal (37th District), Laurie Cumbo (35th District), Mark Treyger (47th District), Chaim Deutsch (48th District), Robert Cornegy (36th District), Carlos Menchaca (38th District), Daniel Garodnick (4th District), Margaret Chin (1st District), Rosie Mendez (2nd District), Ritchie Torres (15th District), Bill Perkins (9th District) and Alan Maisel (46th District, who sent the same letter four days later).

- Grassroots advocates: over 300 people signed this petition! Many people visited places in their neighborhoods to help them get off the list; our map of nonprofits included in the sale has 10,890 views!

Next steps! Here’s how you can help protect the 176 community properties still at risk:

-

PROTECT PLACES IN YOUR NEIGHBORHOOD

Find them on our map (below), contact them using our list with organization names, and stop by (the map and list were updated on June 8). Help administrators of nonprofits navigate the steps to resolve their situation using the Property Tax Reform page of our website before the new deadline of Friday, June 23.

-

ADD YOUR VOICE

-

ENCOURAGE OUR ELECTED ADVOCATES

If your Council Member signed the letter (this is listed above), call and thank them! If they didn’t, call and ask them to send a similar letter (they can use this text). Remind them that the Department of Finance sent them an email on June 1 announcing this deadline extension, and urge them to help the nonprofits in their districts still on the list get out! Call your Borough President and the Public Advocate to thank them for their leadership or ask them to step up! Ask everyone you talk to to demand a moratorium on including debt on nonprofit-owned properties and vacant lots in the 2017 tax lien sale, if they haven’t already. Look up who represents you and everyone’s contact information here.

Get background information and press links to read and share here.

Thank you so much for your advocacy!