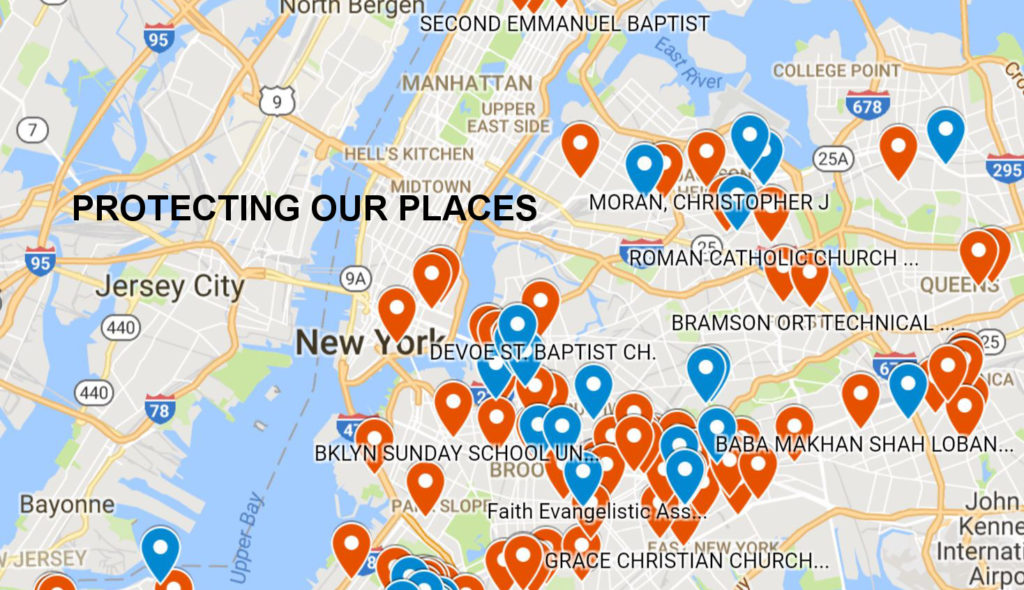

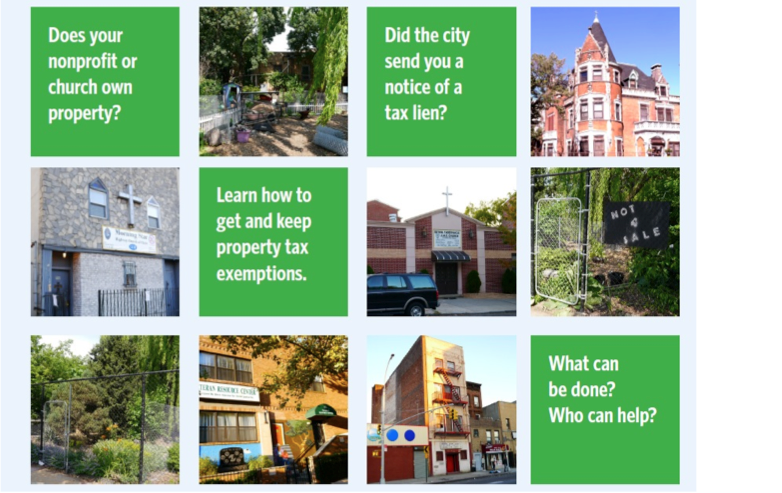

Help protect community places from illegal foreclosure

The NYC Department of Finance sells tax debt owed to the city to private speculative debt collectors each year through the tax lien sale. It routinely includes active nonprofits, even though they are exempt from paying taxes as per New [...]