Deadline is next Thursday, May 11: WE COULD LOSE 349 OF OUR PLACES!

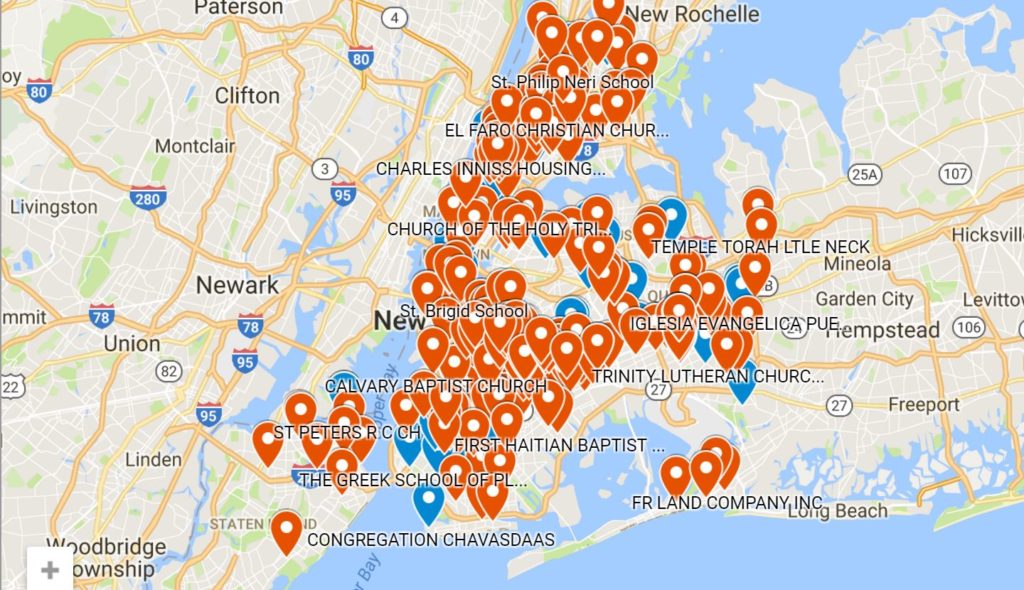

Active community centers, gardens, churches, cultural hubs, veteran’s resource centers and other nonprofit-owned properties that New Yorkers rely on are entitled to tax exemptions by NYS law. Their improperly-sent tax bills will be sold to private debt collectors next week . . . unless we stop it!

HERE’S WHAT WE CAN DO:

- PROTECT INDIVIDUAL COMMUNITY PROPERTIES

Check this map and this list for your organization’s property or active places in your neighborhood. Whoever is in charge of the nonprofit should call the Department of Finance Taxpayer Advocate’s Office IMMEDIATELY and ask that your organization’s property be TAKEN OFF THE LIST: (212) 312-1800. For water debt, call the Department of Environmental Protection Ombudsperson: (718) 595-OMBU. Let people know if their property is listed. More info here. - SIGN THIS PETITION CALLING FOR COMMUNITY PROPERTIES AND VACANT LAND TO BE REMOVED FROM THE MAY 12 SALE

As a result of our advocacy, the Department of Finance created lists of these two kinds of properties. Now we are asking Mayor Bill de Blasio and Department of Finance Commissioner Jacques Jiha to use these lists to remove them from the sale! SIGN THIS PETITION NOW. - CALL YOUR BOROUGH PRESIDENT AND COUNCIL MEMBER

Ask them to demand a moratorium on including debt on nonprofit-owned properties and vacant lots in the 2017 tax lien sale. Look them up here. - SHARE THIS EDITORIAL IN YESTERDAY’S CITY & STATE

Next week, “the New York City Department of Finance will bankrupt and destroy 349 nonprofit institutions, converting their properties into capital for private banks, but city leaders still have a chance to save them.” New York City Must Prevent Nonprofit Properties from Falling to Private Capital by 596 Acres Advisory Committee member Josh Bisker tells about the basis of our work with impacted organizations over the last two years.

More information at 596acres.org/protecting-our-

Share this with your neighbors to protect places that matter!

CORRECTION: ”News from the Acres – April 29, 2017” incorrectly stated that the Department of Finance Tax Lien Sale was taking place on May 17. This is incorrect. The correct date of the Tax Lien Sale is next Friday, May 12.